In the complex world of financing, short-term business loans often come to the rescue of entrepreneurs in need of quick capital. Whether you’re dealing with broken equipment or bad credit, a short-term loan can be a lifesaver. But what exactly are short-term loans, and how do they fit into the financial ecosystem of a small business? In this article, we’ll explore the nitty-gritty of short-term loans, factoring, unsecured loans, and much more.

What Are Short-Term Business Loans?

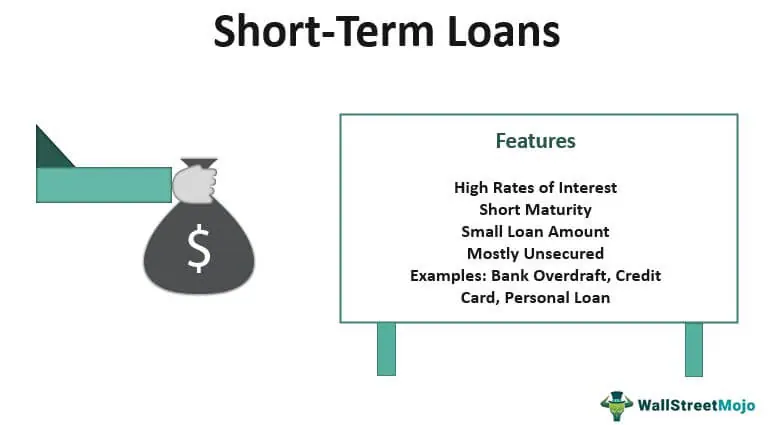

Short-term business loans are, as the name suggests, loans that are designed to be repaid in a short period, typically less than a year. These types of loans are beneficial for addressing immediate needs like invoicing, cash flow, or even dealing with unexpected expenses.

Why Do Small Companies Need Them?

You might wonder why a small business would opt for a short-term loan as opposed to long-term financing. Well, small companies often face immediate challenges that require quick financial solutions. A long-term loan might not be the best fit when you need to replace broken machinery right away or meet a surge in demand.

The Impact of Bad Credit

When it comes to obtaining any type of loan, credit score often plays a crucial role. But what if you have bad credit? The good news is that some lenders offer short-term business loans to entrepreneurs with less-than-stellar credit histories. However, be prepared for higher interest rates as a trade-off.

Unsecured vs Secured Short-Term Loans

An unsecured loan doesn’t require you to put up any collateral, which is beneficial if you’re unwilling or unable to secure the loan with business or personal assets. On the other hand, secured loans typically offer lower interest rates, but there’s the risk of losing your collateral if you default.

Invoicing and Factoring

For businesses struggling with cash flow due to unpaid invoices, factoring is a viable option. Factoring involves selling your invoices to a third-party company at a discount. While you won’t get the full amount, you’ll get immediate cash, allowing you to continue your business operations smoothly.

Big Tech and Financing Options

Big tech companies like Amazon and PayPal are now offering short-term business loans as well. These can be beneficial for small businesses that already utilize these platforms for other business operations. Their application processes are often quicker, and approval rates are high, but the costs can be more expensive than traditional loans.

Conclusion

In summary, short-term loans can be a powerful tool for small businesses in need of quick capital. Whether you’re dealing with invoicing issues, bad credit, or broken equipment, various options are available, including unsecured loans and factoring. Just be sure to weigh the pros and cons before diving in.

FAQs

1. What is the typical repayment period for a short-term business loan?

Typically, you’ll need to repay the loan within a year, although terms may vary depending on the lender.

2. Can I get a short-term business loan with bad credit?

Yes, but be prepared for higher interest rates.

3. Is factoring a good alternative to a short-term loan?

Factoring can be beneficial for immediate cash needs but know that you’ll receive less money than the invoiced amount.

4. How do big tech companies like Amazon offer short-term loans?

Big tech companies often offer quick approval processes and high approval rates but can be more expensive than traditional lenders.

5. Are short-term business loans unsecured?

Some are, but you might also find secure options that require collateral but offer lower interest rates.