Introduction

Chicago, with its rich culinary tapestry, is home to a myriad of eateries that have been at the forefront of America’s food revolution. But the restaurant industry, especially in bustling urban hubs like Chicago, has always been one of slim margins and big challenges. Recently, a new issue has joined the fray – the tipping debate. Amidst these challenges, the emerging world of lending, particularly targeted towards small businesses, has become a beacon of hope. Let’s explore this duality.

Understanding the Tipping Debate

1. Historical Context: From its European origins to its adoption in American dining culture, tipping has been both a tradition and a point of contention.

2. Chicago’s Unique Struggle: With a mix of upscale diners and local eateries, Chicago’s diverse restaurant landscape grapples with tipping disparities.

3. To Tip or Not to Tip: The ethical and financial implications of tipping, and the rise of no-tip restaurants.

The Financial Strain on Restaurants

1. Operating on Slim Margins: The economic dynamics of running a restaurant.

2. Unexpected Challenges: From pandemics to supply chain disruptions, restaurants have had their share of hurdles.

3. Tipping’s Impact on Bottom Line: How tipping, or the lack of it, affects a restaurant’s financial health.

Enter Alternative Lending: A Ray of Hope

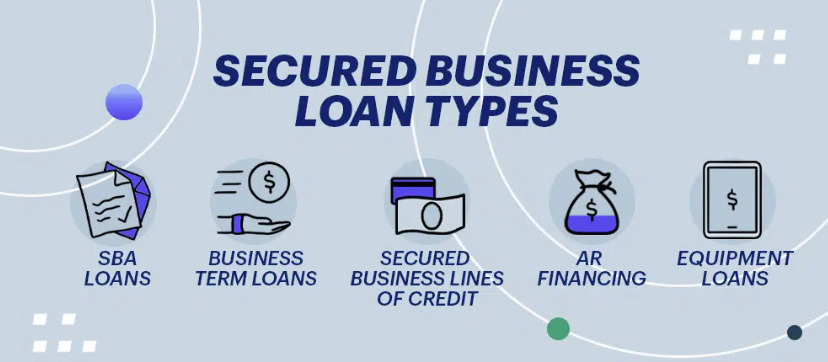

1. Beyond Traditional Loans: Exploring new-age, flexible, and primarily online lending solutions.

2. The Advantage of Small Business Loan Terms: How alternative lending structures, with their accommodating small business loan terms, are becoming the preferred choice for restaurateurs.

3. Trust, Integrity, and Accountability in Lending: Lending isn’t just about money. It’s about building a relationship based on trust.

The Role of Qualifier in Restaurant Financing

1. Customized Loan Solutions: Recognizing that every restaurant is unique, Qualifier offers loan solutions tailored to each business’s needs.

2. Transparent Small Business Loan Terms: With Qualifier, restaurateurs understand their commitments, ensuring no surprises down the road.

3. Success Stories: Testimonials from Chicago-based restaurants that turned their fortunes around with the help of Qualifier’s lending solutions.

Balancing the Tipping Equation with Financial Stability

1. Using Loans to Offset Tip Disparities: How some restaurants are leveraging loans to ensure their staff is paid fairly, irrespective of tipping patterns.

2. Investing in the Future: Lending as a means for restaurants to innovate, adapt, and grow in a changing landscape.

Conclusion

Chicago’s restaurant scene, while vibrant and diverse, is not without its challenges. The tipping debate adds another layer to the complex matrix of financial concerns these establishments face. However, in the world of alternative lending, restaurants find a partner, a collaborator, and sometimes a savior. Platforms like Qualifier, with their flexible and transparent lending terms, are ensuring that Chicago’s eateries continue to satiate our palates while navigating the intricacies of the tipping culture.