Introduction

Hey there! If you’re reading this, you’re probably wondering if it’s possible to secure an SBA loan with less-than-perfect credit. We’ve all been there, life happens, and sometimes our credit takes a hit. Let’s dive deep into this topic and uncover the truth.

What is an SBA Loan?

First off, what even is an SBA loan? The Small Business Administration (SBA) provides these loans to support and encourage small businesses. But here’s the catch: the SBA doesn’t lend money directly.

Importance of SBA Loans

For small businesses, these loans are a game-changer. They offer longer repayment terms and lower interest rates compared to other business loans. Sounds tempting, right?

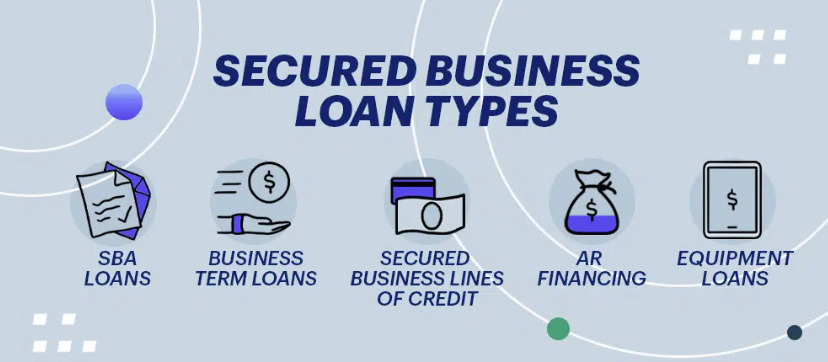

Common Types of SBA Loans

There are various flavors to pick from – 7(a) loans, 504 loans, and microloans, to name a few. Each serves a unique purpose, so understanding which one fits your needs is crucial.

Understanding Credit Score

Before we delve deeper, it’s essential to know what a credit score is. Think of it as your financial report card. It’s a reflection of how responsibly you’ve managed your finances.

How is it Calculated?

Factors like payment history, debt amount, length of credit history, and recent credits play a role. Ever wondered why paying bills on time is emphasized? Now you know!

What Constitutes Bad Credit?

Typically, scores below 580 are deemed poor. But hey, it’s just a number. What’s important is understanding its implications and working towards improving it.

Can Bad Credit Affect SBA Loan Approval?

Yes and no. While credit is a factor, it’s not the only one. The SBA also considers your business’s health, cash flow, and collateral.

Impact on Loan Terms

Bad credit might mean less favorable terms. Think of it like hiking with a heavier backpack – doable but challenging.

Impact on Interest Rates

A lower credit score might also mean higher interest rates. Imagine it as a seesaw, with credit score and interest rate on opposite ends.

Ways to Improve Your Credit Score

All’s not lost! Start by reviewing credit reports, paying bills on time, and reducing debts. Remember, Rome wasn’t built in a day.

Alternatives to SBA Loans

If SBA isn’t in the cards, there are alternatives. Merchant cash advances, business credit cards, or personal loans can be explored. There’s always a way!

Success Stories

Many entrepreneurs with bad credit have still bagged that SBA loan. Their secret? Persistence, preparation, and a solid business plan.

Tips for SBA Loan Applicants with Bad Credit

Understanding Your Situation

First and foremost, understanding your financial situation is paramount. Recognizing that there’s room for improvement is half the battle. By getting a full picture of your finances, you can take active measures to enhance your chances of loan approval.

Crafting a Solid Business Plan

Whether you’re starting anew or expanding, a well-thought-out business plan can make all the difference. It can demonstrate to lenders that you have a clear vision and strategy. Remember, lenders want assurance that their money will be put to good use and that you’ll be able to pay it back.

Gathering Collateral

Assets can speak louder than credit scores. By offering collateral, you provide lenders with an added layer of security. This can sometimes offset the risk associated with lending to someone with a lower credit score.

Seek a Co-Signer

A co-signer can act as a safety net for lenders. By having someone with a better credit score vouch for your loan, you increase the odds of approval. However, remember that this person will be responsible for the loan if you default. It’s not a decision to be taken lightly.

Engage in Credit Counseling

There are numerous credit counseling agencies that can guide you in managing debt and improving your credit score. Taking such proactive steps can show lenders your commitment to financial responsibility.

Building Relationships with Lenders

Sometimes, it’s not just about the numbers. Building a relationship with your bank or lender can give you an edge. Having a face to the name and a story to your business can evoke trust and confidence.

Seeking Specialized Lenders

Not all lenders view bad credit in the same light. Some lenders specialize in working with individuals or businesses with lower credit scores. By researching and approaching these institutions, you can increase your chances of finding a loan that suits your needs.

Stay Persistent

In the world of finance, persistence is key. While one door might close, another might open. Rejections can be disheartening, but it’s essential to keep pushing forward. Learn from feedback, make necessary adjustments, and keep applying.

Final Words

Navigating the realm of SBA loans with bad credit can be daunting. But armed with the right knowledge, strategy, and attitude, it is entirely possible to secure that much-needed loan. Focus on showcasing the strength and potential of your business, continually work on improving your credit score, and explore all available avenues. Your entrepreneurial dream deserves every chance to thrive.

Additional FAQs

1. Do all SBA loans require collateral?

Not always, but having collateral can enhance your chances, especially with larger loans.

2. Can I refinance an SBA loan?

Yes, under specific circumstances. It’s best to discuss this with your lender.

3. How can I check my eligibility for an SBA loan?

The SBA’s website provides detailed eligibility criteria for different loan programs.

4. What if I’ve previously defaulted on a loan?

It can make the process tougher, but it doesn’t rule you out. Be prepared to provide a detailed explanation and show measures taken to rectify the situation.

5. Are there any fees associated with SBA loans?

Yes, fees can vary based on the loan type and amount. Always clarify these details with your lender.