As businesses strive to maintain their competitive edge and seize growth opportunities, the role of equipment becomes increasingly pivotal. Whether it’s updating machinery, acquiring advanced technology, or expanding operational capabilities, equipment financing bridges the gap between vision and reality. However, in the face of inflation, equipment loan rates and approvals have taken center stage, introducing a layer of complexity to this crucial process.

Navigating the Landscape of Equipment Financing

The journey to acquiring essential equipment requires a comprehensive understanding of various factors, with equipment loan rates being a central concern. These rates, influenced by economic dynamics, inflation, and lending practices, play a pivotal role in determining the overall cost of financing.

The Interplay of Interest Rates and Inflation

Inflation is a double-edged sword that can both propel and hinder economic growth. As inflation rates rise, they impact interest rates, including those associated with equipment loans. Understanding this relationship is crucial for businesses seeking sustainable financing solutions.

The Factors That Influence Equipment Loan Rates

Equipment loan rates are not solely dictated by inflation; they are shaped by a blend of market forces, lender policies, and economic indicators. Businesses must consider these multifaceted elements when gauging the feasibility of equipment financing.

The Relationship Between Inflation and Borrowing

Inflation’s impact extends beyond price tags—it influences borrowing power. In an inflationary environment, lenders may adjust loan rates to mitigate risk, potentially leading to higher borrowing costs for businesses.

How Inflation Affects Equipment Loan Approvals

Inflation can create a ripple effect that reaches the realm of loan approvals. As lenders assess the potential risks associated with inflation, they may tighten approval criteria, making it imperative for businesses to present compelling cases for financing.

Adapting to Changing Economic Realities

To navigate the challenges posed by inflation, businesses must adapt their financing strategies. This could involve exploring different loan structures, diversifying financing sources, or engaging with financial advisors who can provide valuable insights.

Leveraging Fixed-Rate Equipment Loans

Fixed-rate equipment loans offer stability in uncertain times. With interest rates locked in, businesses can plan their finances more effectively and mitigate the uncertainties posed by inflation.

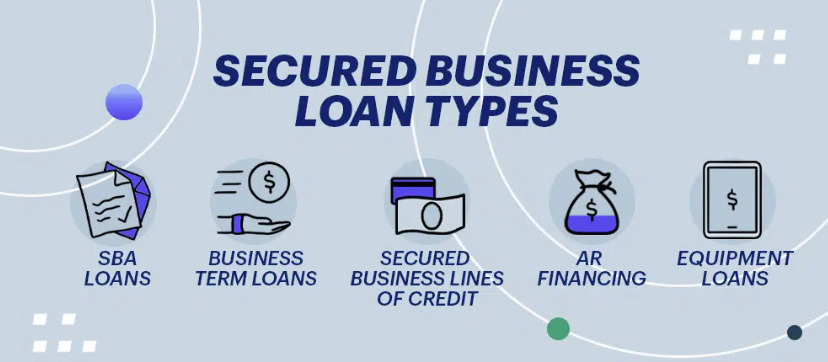

Exploring Alternatives Amid Inflationary Pressures

Innovation extends to financing options as well. Businesses can explore alternatives such as leasing, rent-to-own agreements, or exploring partnerships that alleviate the impact of inflation on equipment acquisitions.

Negotiating Competitive Equipment Loan Rates

Businesses hold the power to negotiate competitive loan rates. By leveraging their financial health, business plans, and lender relationships, they can secure favorable terms even in inflationary periods.

The Role of Collateral in Securing Favourable Terms

Collateral serves as a safety net for lenders and borrowers alike. Businesses that offer valuable collateral can enhance their bargaining position and secure more favorable loan terms.

Evaluating Loan Terms Against Inflation

When assessing loan terms, it’s vital to consider inflation’s potential effects on repayment. Businesses should evaluate their capacity to service loans as inflation evolves.

Staying Ahead of Economic Trends

Economic forecasting becomes indispensable in an inflationary environment. Businesses can benefit from staying informed about inflation projections and economic trends that impact equipment loan rates.

Engaging with Financial Advisors for Insights

The expertise of financial advisors can be a guiding light in turbulent economic times. Their insights can inform businesses’ financing decisions, aligning them with economic realities.

Aligning Equipment Financing with Economic Outlook

Equipment financing should be a strategic endeavor, aligned with a business’s economic outlook and growth aspirations. Flexibility and foresight are key elements in this alignment.

Preparing for Fluctuating Loan Rates

In an inflationary environment, businesses should anticipate fluctuating loan rates and build resilience into their financial planning. Contingency strategies can help absorb unexpected changes.

Diversifying Financing Strategies

Diversification is a risk management principle that extends to financing strategies. Businesses can explore a mix of financing options to mitigate the impact of inflation on their equipment acquisitions.

Balancing Business Investments and Loans

Effective financial management requires a delicate balance between investments and loans. Businesses must prioritize growth initiatives while ensuring debt remains manageable.

Navigating Equipment Financing in an Inflationary Environment

In conclusion, the landscape of equipment financing is evolving within an inflationary environment. Businesses that grasp the interplay of equipment loan rates and inflation can make informed decisions that equip them for sustainable growth.

FAQs

1. How does inflation impact equipment loan rates?

Inflation can lead to higher interest rates on equipment loans, potentially affecting borrowing costs for businesses.

2. What strategies can businesses employ to navigate inflation’s impact on equipment financing?

Businesses can consider fixed-rate loans, explore alternatives, negotiate competitive rates, and engage with financial advisors for insights.

3. How can economic forecasting assist businesses in an inflationary environment?

Economic forecasting provides businesses with insights into inflation projections and economic trends, helping them align their financing strategies.

4. What role does collateral play in securing favorable equipment loan terms?

Collateral enhances a business’s bargaining position, leading to more favorable loan terms and conditions.

5. How can businesses balance their investments and loans effectively?

Businesses must prioritize growth initiatives while ensuring their debt load remains manageable, striking a balance between investments and loans.