Small Business Bankruptcies and the Emergence of Alternative Lending

With the fluctuating economic landscape and the challenges faced by small businesses, bankruptcy rates have seen a significant surge, reminiscent of the peak during the pandemic. Traditional financial avenues often fall short in such turbulent times. Yet, amid these trials, alternative lending platforms, particularly ones like Qualifier.co, emerge as saviors, helping small businesses stay afloat, rebuild, and even thrive. In this article, we explore the role of alternative lending in combating the rising small business bankruptcies and how Qualifier.co stands out in this arena.

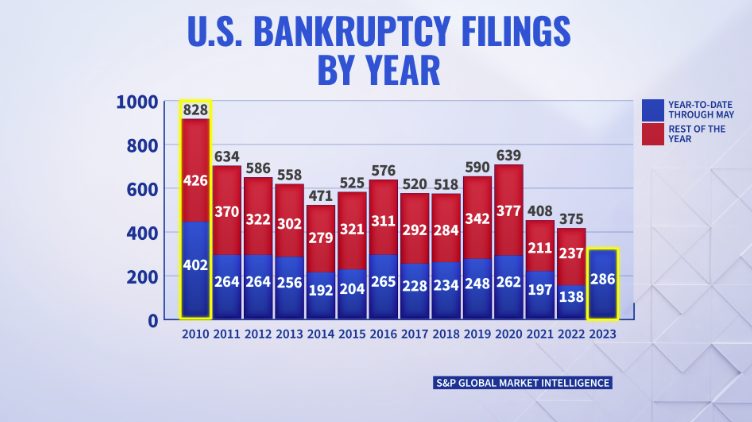

The Surge in Small Business Bankruptcies

It’s no secret that small businesses form the backbone of the economy. Yet, they are often the most vulnerable to financial downturns. Post-pandemic, there was hope for stabilization, but recent data shows a spike in bankruptcies. With traditional financial structures proving inadequate, where do these businesses turn?

Traditional Banking’s Limitations

- Lack of Flexibility: Conventional banks have stringent criteria, which many small businesses can’t fulfill.

- Long Processing Times: Time is often of the essence, and traditional banks usually have lengthy loan processing periods.

- Low Approval Rates: With the increased risks, banks are even more cautious, leading to high rejection rates for loan applications.

Alternative Lending: A Beacon of Hope

Alternative lending platforms have changed the financing game. These platforms:

- Offer a higher approval rate.

- Provide swift processing times.

- Extend customizable loan options tailored to the business’s needs.

Moreover, they harness the power of technology to assess risks and make informed lending decisions.

Qualifier.co is not just another lending platform. It’s an embodiment of integrity and accountability in the lending world. They’ve established themselves as a trusted source for small businesses in need. Their platform:

- Connects businesses with an array of lenders.

- Offers transparent terms with no hidden fees.

- Ensures a streamlined application process, often with funds deposited swiftly.

With a focus on short-term loans, Qualifier.co provides businesses with the immediate financial cushion they need to navigate through rough patches.

Features That Set Qualifier.co Apart

- Integrity and Accountability: They prioritize transparent operations, ensuring businesses understand the terms clearly.

- Well-Researched Matching: Qualifier.co matches businesses with lenders best suited for their specific needs.

- Focus on Short-Term Loans: Recognizing the immediate needs of businesses, they specialize in short-term loans, ideal for addressing pressing financial concerns.

Warning Signs of Economic Distress for Entrepreneurs

Despite the optimism that frequently accompanies economic recovery periods, numerous indicators suggest that not all small businesses are on the path to a soft-landing post-crisis. Here’s a deeper dive into the signals of economic distress that are particularly concerning for entrepreneurs:

1. Declining Sales: One of the most immediate indicators is a consistent drop in sales. While a temporary dip can occur in any business cycle, prolonged declining sales patterns indicate deeper underlying issues.

2. Increasing Debt Levels: Rising debt, especially in comparison to revenue or against the industry average, is a red flag. The more a business owes, the harder it becomes to secure additional financing from traditional banks.

3. Cash Flow Constraints: A business that constantly finds itself juggling payments, delaying vendor settlements, or struggling to meet payroll, is undoubtedly facing cash flow issues.

4. Difficulty Accessing Capital: Traditional lenders become more conservative during economic downturns. Many small businesses find their applications for additional capital rejected or only partially funded.

5. Shrinking Margins: If costs rise but prices remain stagnant due to competition or market saturation, profit margins can thin out, making it hard for businesses to reinvest or even maintain operations.

6. Rising Customer Complaints: An uptick in customer complaints or returns can indicate issues with product quality or service, which can erode brand reputation and loyalty.

7. Delayed Inventory Turnover: If inventory sits longer than usual without turning over, it ties up funds that could be used elsewhere in the business.

How Qualifier.co Provides a Lifeline to Struggling Businesses

In the face of these economic distress signals, platforms like Qualifier.co emerge as essential allies for small businesses. Here’s how they can play a pivotal role in helping businesses navigate rough waters:

1. Alternative Lending Solutions: When traditional banks turn businesses away, alternative lending platforms like Qualifier.co offer alternative solutions, such as short-term loans, which can be easier to qualify for and are often processed faster.

2. Flexible Terms: Qualifier.co understands the unique challenges faced by small businesses. They offer flexible loan terms tailored to a company’s specific needs, ensuring that repayments don’t become an added burden.

3. Transparent Operations: With no hidden fees or complicated terms, businesses can trust Qualifier.co to provide straightforward lending solutions.

4. Cash Flow Boost: Quick access to capital can be a game-changer for businesses facing cash flow issues. It can help settle debts, replenish inventory, invest in marketing, or even fund innovation to pivot the business model.

5. Advisory Services: Beyond just providing financial assistance, platforms like Qualifier.co often offer advisory services, guiding businesses on the best ways to utilize their loans for maximum impact.

6. Building Business Credit: By securing and successfully repaying loans through platforms like Qualifier.co, businesses can improve their credit score, increasing their chances of securing more substantial financing in the future.

In the face of economic challenges, entrepreneurs need partners they can trust. Qualifier.co offers not just financial solutions but a partnership that can guide businesses back to stability and growth. For many entrepreneurs, this support can make the difference between shutting their doors and steering their business toward a brighter future.

Conclusion: The Way Forward for Small Businesses

The rising tide of bankruptcies might seem daunting, but with platforms like Qualifier.co, there’s a ray of hope for small businesses. Alternative lending, particularly when steered by trusted platforms, can be the difference between a business’s downfall and its resurgence.