How to Secure a Business Loan: Navigating the Path to Financial Empowerment

In the dynamic arena of entrepreneurship, securing a business loan is akin to unlocking new realms of growth and opportunity. For small companies and big tech startups alike, a well-timed loan can be the difference between scaling new heights or struggling to keep the lights on. This guide delves into the world of business financing,…

How to Calculate a Bridge Loan for Your Small Business

Navigating the financial waters of running a small business can often feel like steering a ship through a storm. One minute you’re sailing smoothly, and the next, you’re searching for a lifeline to bridge the gap between your current needs and future revenue. Enter the concept of a bridge loan, a crucial financial tool for…

How Big Tech Broke Loan Companies are Accelerating the Process for Small Businesses

In the evolving business finance landscape, the rise of big tech firms in the loan sector marks a revolutionary shift, offering small businesses a lifeline in their quest for growth. This article delves into how these tech giants are reshaping the traditional lending model, making it more accessible and efficient for small enterprises to secure…

Equipment Loans for Small Businesses: A Comprehensive Guide

In the bustling world of small businesses, the right equipment can be the linchpin of success, propelling operations forward and enabling growth and efficiency. This is where equipment loans come into play, offering a lifeline to businesses needing to upgrade or purchase new machinery without depleting their cash reserves. Let’s explore equipment loans, how they…

How to Get a Small Business Loan Now After PPP Loans are Over

The conclusion of the Paycheck Protection Program (PPP) loans marks a significant turning point for small businesses navigating the post-pandemic economic landscape. With PPP loans providing a critical financial lifeline during unprecedented times, small businesses must now explore alternative financing options to sustain and grow their operations. This comprehensive guide delves into practical steps and…

How a Company Uses a Bridge Loan Calculator to Get a Small Business Loan

In today’s fast-paced business environment, timing is everything. For small companies aiming to navigate the complex landscape of growth and sustainability, understanding and leveraging financial tools like bridge loans can be a game-changer. A bridge loan calculator becomes an indispensable tool in this journey, offering insights and guiding small businesses through securing a small business…

How SBA Loan Interest Rates Help Smaller Companies Invest in Their Business

In the dynamic world of small business financing, understanding the nuances of SBA loan interest rates can be a game-changer for smaller companies. The financial landscape constantly evolves, particularly in the face of challenges posed by bad credit, and companies need options. Small Business Administration (SBA) loans are designed to assist small businesses that might…

A Guide to Small Business Loan Requirements: Unlocking the Door to Financial Growth

Navigating the world of small business financing can often feel like trying to solve a complex puzzle. With each financial product, be it a business line of credit, unsecured loans, or short-term business loans, comes a unique set of challenges and requirements. This comprehensive guide aims to demystify the process, providing you with the insights…

A 5 or 10 Year Term Loan for Your Business: Navigating Long-Term Financing for Sustained Growth

Embarking on a business venture is akin to setting sail on a vast, unpredictable ocean. Just as a sturdy ship needs a robust sail to harness the wind’s power, a business requires solid financial backing to capitalize on growth opportunities. A 5 or 10-year term loan represents such a financial sail, offering businesses the capital…

How to Obtain a Loan for a Franchise: Navigating the Financial Path to Business Ownership

Embarking on a franchise business venture is an exciting journey, blending the allure of entrepreneurship with the stability of proven business models. However, this journey often begins with a significant hurdle – securing the necessary financing. Obtaining a loan for a franchise can seem daunting, but with the right approach and understanding, it becomes a…

The Comprehensive Guide to Asset Financing: Unlocking Business Potential

Introduction to Asset Financing Asset financing is a powerful tool for businesses looking to leverage their assets to secure funding. In today’s fast-paced economic environment, understanding and utilizing asset financing can be a game-changer for companies of all sizes. This form of financing allows businesses to unlock the value of their assets, providing the necessary…

Unlocking the Potential of Commercial Property Loans

Introduction Have you ever dreamed of owning a commercial property, but felt overwhelmed by the idea of securing a loan? You’re not alone. Commercial property loans can be a game-changer for businesses and investors, yet many find the process daunting. This article is your guide to understanding and successfully obtaining a commercial property loan. What…

Unlocking Business Loans: The Impact of Working Capital Ratios

Introduction Have you ever wondered what makes a business loan application tick? Imagine walking into a bank, confident and ready, only to be faced with a barrage of financial terms that sound more like rocket science. Well, fear not! Today, we’re going to unravel one of these mysteries: the ‘working capital ratio’. Think of it…

Navigating Small Business Loans with No Credit Check: Opportunities and Insights

Introduction In the realm of small business financing, credit checks can be a significant barrier. This brings into focus the concept of no credit check loans – a lifeline for businesses with less-than-perfect credit scores or those just starting out. What are No Credit Check Small Business Loans? Definition and Nature These loans are unique…

Fast Short Term Business Loans: A Quick Solution for Immediate Financial Needs

Introduction In the fast-paced world of business, sometimes opportunities or challenges arise that require immediate financial attention. Fast short-term business loans are designed to meet such urgent needs, offering a quick influx of cash to handle sudden expenses or capitalize on timely opportunities. What Are Fast Short Term Business Loans? Definition and Characteristics Fast short-term…

Equipment Loan Rates: Navigating Your Options for Better Business Growth

Introduction When it comes to scaling a business, acquiring the right equipment is often a pivotal step. However, the significant financial investment required for such acquisitions can be a substantial hurdle. This is where equipment loans come in handy. Understanding equipment loan rates is crucial for any business owner looking to make informed financial decisions. …

Revitalizing Small Businesses: The Impact of Short-Term Loans

Navigating the Economic Challenges: A Ray of Hope for Entrepreneurs In today’s dynamic economic landscape, small business owners face unprecedented challenges. With fluctuating market trends and financial uncertainties, the path ahead seems daunting. Yet, amidst these turbulent times, short-term business loans emerge as a beacon of hope, offering a viable solution for businesses striving to…

With Interest Rates above 9% Small Business Owners are looking for Alternative Options

Rising Above the Tide: Understanding the Current Economic Climate In today’s dynamic economic landscape, small business owners face a significant challenge as interest rates climb above 9%. This surge necessitates a strategic pivot towards alternative financing options. Understanding the root causes and potential solutions is crucial for businesses aiming to thrive despite these financial hurdles.…

Small Businesses Turn to Advertise on “Xs” Platform

Leveraging Platform X for Business Growth In today’s competitive digital landscape, small businesses are increasingly gravitating towards Platform X for advertising. This shift signifies a strategic move to harness the vast potential of Platform X’s user base and advanced targeting capabilities. Cost-Effective Advertising Solutions The allure of Platform X lies in its budget-friendly advertising options.…

Unlocking Financial Flexibility: The Comprehensive Guide to Short-Term Business Loans

Introduction: Navigating the Landscape of Short-Term Business Loans In the fast-paced business world, staying financially agile is key. Short-term business loans emerge as a pivotal tool, offering a quick influx of capital to address immediate needs. This article sheds light on the nuances of these loans, their benefits, and strategic usage in various business scenarios.…

Navigating the World of Secured Business Loans: A Comprehensive Guide

Introduction Secured business loans are a cornerstone in the world of business financing, offering a pathway for businesses to access necessary funds while providing lenders with added security. This 900-word article delves into the intricacies of secured business loans, exploring their nature, benefits, risks, and strategic approaches to leveraging them for business growth. Understanding Secured…

Harnessing Business Loans Based on Revenue: A Strategic Approach for Growth

Introduction In the landscape of business financing, loans based on revenue stand out as a vital tool for businesses seeking growth and stability. Unlike traditional loans, which rely heavily on credit scores and collateral, revenue-based financing offers a more flexible alternative. This 800-word article explores the nuances of business loans based on revenue, highlighting their…

The Pros and Cons of a Business Line of Credit

Introduction In the dynamic world of business finance, a business line of credit stands out as a flexible financing option for companies. It’s a revolving loan that allows businesses to borrow up to a certain limit and pay interest only on the amount borrowed. This article delves into the advantages and drawbacks of using a…

Quick Short Term Business Loans: A Comprehensive Guide

Introduction to Short Term Business Loans Every business, regardless of its size, might encounter financial hiccups. Enter quick short-term business loans—a lifeline for many enterprises. But what exactly are they? Why Businesses Need Short-Term Loans Imagine running a restaurant and suddenly your main oven breaks. Or, perhaps you run an e-commerce store, and there’s an…

Can You Get an SBA Loan with Bad Credit?

Introduction Hey there! If you’re reading this, you’re probably wondering if it’s possible to secure an SBA loan with less-than-perfect credit. We’ve all been there, life happens, and sometimes our credit takes a hit. Let’s dive deep into this topic and uncover the truth. What is an SBA Loan? First off, what even is an…

Bad Credit Business Line of Credit: An In-depth Guide

Do you find the idea of getting a business line of credit with bad credit a bit perplexing? If so, you’re not alone. Let’s demystify this topic. What is a Line of Credit? Basic Concept A line of credit is somewhat similar to a credit card. It offers a pool of funds that businesses can…

Navigating Small Business Loan Terms: Your Comprehensive Guide

Understanding the Basics of Small Business Loan Terms When you’re a small business owner, securing funding can be a pivotal step in your journey. Delving into the world of small business term loans means understanding a myriad of terms and conditions. Why Small Business Term Loans Matter A crucial aspect of keeping your enterprise buoyant…

Fast Short-Term Business Loans: A Guide for the General Public

We’ve all been there – one moment, your business is humming along just fine. The next? An unexpected need arises, and you find yourself in a cash crunch. What’s the quick fix? You guessed it: fast short-term business loans. But what are they, really? And how can they be a lifeline for your business? What…

Equipment Loan for Small Business: The Ultimate Guide

In today’s fast-paced business environment, acquiring the right tools can be a game-changer for small businesses. Equipment loans for small businesses can be the golden ticket for such endeavors. Let’s dive deep into this topic, shall we? Understanding the Basics of Equipment Loan for Small Business When you’re running a small business, having access to…

Liquor & Convenience Stores Gear Up for 2023: The Role of Short-Term Lending in Inventory Enhancement

Introduction 2023 is poised to be an impactful year for liquor and convenience stores across the US. As these establishments aim for growth, diversification, and profit maximization, having adequate inventory is crucial to match consumer demands. But, sourcing funds for inventory enhancement can be challenging. Enter short-term lending – a financial solution helping these stores…

Chicago’s Tipping Tug-of-War: Balancing Restaurant Challenges with the Power of Loans

Introduction Chicago, with its rich culinary tapestry, is home to a myriad of eateries that have been at the forefront of America’s food revolution. But the restaurant industry, especially in bustling urban hubs like Chicago, has always been one of slim margins and big challenges. Recently, a new issue has joined the fray – the…

Alternative Banks Stand Tall Amidst Rising Rates: A Beacon of Hope for Small Businesses

Introduction Rising interest rates are a double-edged sword. While they reflect economic strength on the one hand, they also portend increased borrowing costs for businesses, especially the smaller ones. In this backdrop, alternative banks are emerging as a pivotal source of support, offering innovative lending solutions. In the midst of these fluctuating economic tides, how…

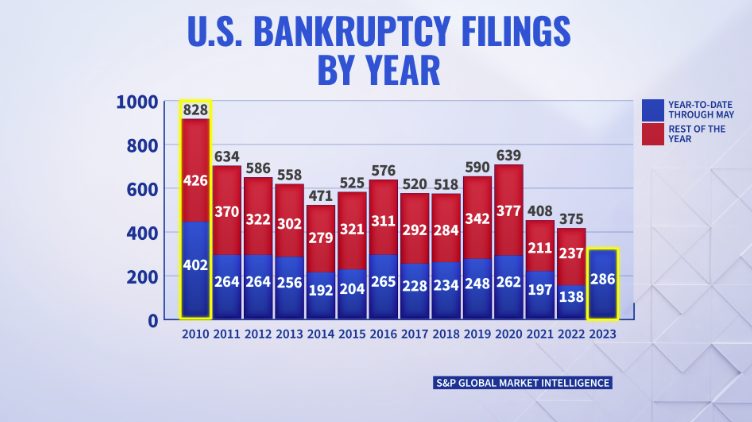

Rising Small Business Bankruptcies: The Saving Grace of Alternative Lending Platforms

Small Business Bankruptcies and the Emergence of Alternative Lending With the fluctuating economic landscape and the challenges faced by small businesses, bankruptcy rates have seen a significant surge, reminiscent of the peak during the pandemic. Traditional financial avenues often fall short in such turbulent times. Yet, amid these trials, alternative lending platforms, particularly ones like…

The Future of Online Small Business Lending

Introduction In the digital era, the realm of lending has undergone a monumental transformation. Once the exclusive purview of brick-and-mortar banks, lending has now been revolutionized by the internet, offering efficiency, flexibility, and innovation. Historical Context The evolution of online lending is a story of technological advancements meeting financial needs. As fintech companies emerged in…

The Art of Timing: Navigating Holiday Decorations for Small Businesses

Holiday decorations play a pivotal role in enhancing the ambiance of various establishments. For small businesses, especially, they can serve as a beacon, drawing customers in. Yet, the question of when to decorate remains. Let’s delve into the complexities of this decision. The Significance of Holiday Decorations: Nothing screams festive like holiday decorations. They not…

A New Era: Bank Lending Tightens on Equipment Loan Rates

Introduction to Bank Lending and Equipment Loans Bank lending, a cornerstone of the global financial system, plays a crucial role in spurring economic growth. By providing businesses with the capital they need, banks fuel innovation, expansion, and job creation. Among the various types of loans offered, equipment loans stand out. They enable businesses to purchase…

How to Obtain a Bad Credit Business Line of Credit When the Chips are Down

Introduction: Understanding the Landscape of Bad Credit Business Lines of Credit Navigating the financial world with a credit score of 650 might seem like you’re sailing against the wind. But hold onto your hat! This isn’t the end of the world; it’s merely a pitstop. Let’s first understand what a 650-credit score means and why…

The 10 Essential Insights on “How Do Small Business Loans Work, With Simpler Requirements”

“Understanding the simpler requirements of small business loans can open doors for budding entrepreneurs and seasoned professionals alike.” Introduction: The Basics of Small Business Loans Every entrepreneur dreams of scaling their business, and financing is a crucial tool in this journey. With the evolution of the lending sector, understanding how small business loans work, especially…

Are Rising Interest Rates Affecting Equipment Finance Loans?

In a rapidly changing economic landscape, small companies face a multitude of challenges. From invoicing to bad credit, the list seems never-ending. Among the burning questions, one that stands out prominently is the impact of rising interest rates on equipment finance loans. You might be wondering, “Is this just another broken spoke in the wheel…

Understanding Short-Term Loans: What You Need to Know

In the complex world of financing, short-term business loans often come to the rescue of entrepreneurs in need of quick capital. Whether you’re dealing with broken equipment or bad credit, a short-term loan can be a lifesaver. But what exactly are short-term loans, and how do they fit into the financial ecosystem of a small…

Business Line of Credit vs Credit Card: Which One Is Right For Your Business?

Decisions, decisions, decisions! When it comes to financing options for your small business, you’re likely considering a range of choices. One common dilemma many business owners face is choosing between a business line of credit and a business credit card. How do you know which one suits your business needs, especially if you’re dealing with…

The Ultimate Guide to Business Loan Brokers: Your Key to Funding Success

Introduction: Unlocking Business Loan Opportunities Applying for a business loan is often a rigorous and time-consuming process. From ensuring you meet lender requirements to gathering the necessary documentation and sifting through multiple loan options, it can be overwhelming. This is especially true for busy entrepreneurs who are already juggling various tasks. But what if there…

Unlocking the Power of Unsecured Business Lines of Credit

How to Secure One Without a Personal Guarantee What Is an Unsecured Business Line of Credit? An unsecured business line of credit is a financial lifesaver for many businesses, offering a reservoir of capital that you can tap into as needed. Unlike traditional business loans that grant a one-time lump sum, lines of credit work…

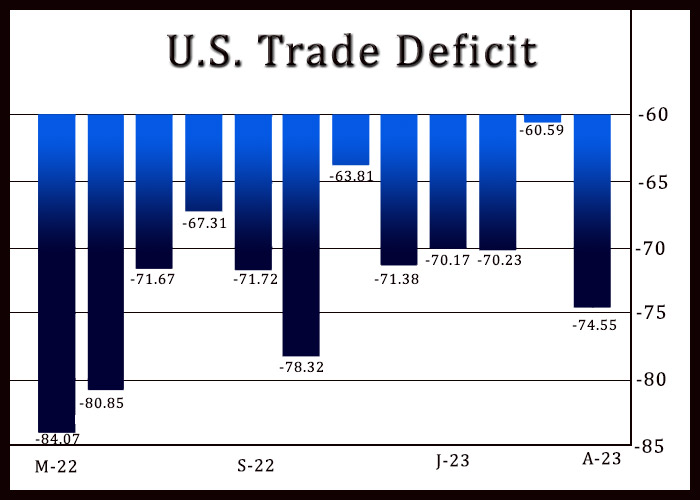

How Short-Term Business Loans Reshuffled the Trade Slump for Small Business Owners

Introduction: The Small Business Conundrum Running a small business is no small feat. Between managing day-to-day operations, keeping employees happy, and striving for growth, entrepreneurs face a myriad of challenges. Among these challenges, financial stability often tops the list. This brings us to the role of short-term business loans in uplifting small businesses. They have…

Revolutionizing Small-Business Lending: The Shift to Small Business Invoice Factoring

In the ever-evolving landscape of small-business financing, change is the only constant. As the engines of innovation and growth, small businesses need efficient access to capital. The traditional avenues, however, often fall short in addressing their unique needs. This article explores how the tides are turning with the emergence of small business invoice factoring—a dynamic…

Shaping Tomorrow’s Funding Today: The Transformational Impact of Short-Term Business Loans Online

In the intricate tapestry of small business operations, the thread that weaves them all together is funding. The quest for financing solutions that match the pace of business innovation has led to a groundbreaking development: short-term business loans online. This article delves into how these online lending platforms are revolutionizing the way small businesses secure…

Navigating Equipment Financing in an Inflationary Environment: The Dynamics of Equipment Loan Rates and Approvals

As businesses strive to maintain their competitive edge and seize growth opportunities, the role of equipment becomes increasingly pivotal. Whether it’s updating machinery, acquiring advanced technology, or expanding operational capabilities, equipment financing bridges the gap between vision and reality. However, in the face of inflation, equipment loan rates and approvals have taken center stage, introducing…

Real Rates Aren’t Your Real Friends, And How Small Business Loan Terms will Affect Your Business

When embarking on the journey of securing a small business loan, the spotlight often shines on the interest rate—the notorious number that impacts your monthly payments. However, there’s a hidden side to loans that demands equal attention: the terms. In this article, we delve into the world of small business loan terms and how they…

With the Race to the 4th Quarter, will Small Business Equipment loans be Affordable for Small Business Owners?

As the 4th quarter approaches, small business owners find themselves caught in a whirlwind of year-end demands and strategic planning. Amidst the hustle, one critical question echoes: Will small business equipment loan remain affordable amidst the frenzy? In this article, we dive into the world of small business equipment loans, exploring affordability concerns and strategies…

With Higher Interest Rates from Big Banks, What’s My Alternative in How to Qualify for a Small Business Loan

In the ever-evolving landscape of small business lending, entrepreneurs face a pressing question: How can I secure a small business loan amidst the challenge of higher interest rates from big banks? This article is your guide to navigating the world of small business loans, exploring alternative paths to qualification, and embracing opportunities beyond the traditional…

How Small Business Loans with No Personal Guarantee Empower Business Owners to Invest in Their Own Ventures Faster

Running a successful business often requires more than just a great idea; it demands financial support to turn those ideas into reality. Securing a business loan can provide the necessary funds, but the notion of a personal guarantee—putting personal assets on the line—can be daunting. However, the landscape is changing, and small business loans with…

How Short Term Business Loans Are Empowering Small Businesses with Increased Access to Working Capital?

Running a successful small business requires more than just innovative ideas and dedication. One of the key factors that ensure a business’s smooth operation and growth is having access to sufficient working capital. However, this need can often be a challenge, especially for small businesses that face cash flow gaps or unexpected expenses. This is…

Simplified Short Term Loans: New Ear for Small Business

The world of finance is in constant evolution, and the latest turn of events sees the domain of short-term loans experiencing a transformative shift. With simpler requirements on the horizon, this could mean more accessible financing options for small businesses. Understanding the Shift in Short Term Loan Requirements Traditional short-term loans have often come with…

Revolutionizing Small-Business Lending: Streamlining Requirements for a Brighter Future

Small-business lending has always been a crucial aspect of economic growth, providing entrepreneurs with the necessary financial support to pursue their dreams. However, traditional lending processes have often posed significant challenges for small-business owners, leading to restricted access to capital and hindered growth opportunities. Fortunately, the landscape of small-business lending is on the cusp of…

The Emergence of New Funding Avenues: Small Businesses Pivot from Bank Lending to Customer Financing and Fintech Solutions

In the face of stringent bank lending practices, small businesses are taking resourceful steps to secure their financial future. As the traditional banking sector tightens its grip, small enterprises are turning to their customers to raise capital. Simultaneously, fintech lending is presenting itself as an unexpected but welcome lifeline, adding a new dimension to small…

The Hiring Boom for Small Businesses Is Hiding a Recession Signal

Understanding the Current Hiring Boom If you’ve been keeping an eye on job boards and recruitment platforms lately, you’ve probably noticed the hiring boom in small businesses. Jobs aplenty, applications streaming in, it all seems like a good sign, right? On the surface, yes, but let’s dive deeper. The Hiring Landscape in Small Businesses Small…

CPI Report Shows Inflation Eased to 3% in June: The Implications for Small Business Growth

Understanding the complexities of economic indicators is essential for businesses of all sizes. The recent CPI (Consumer Price Index) report indicating that inflation eased to 3% in June brings some interesting implications, particularly for small businesses. Let’s unpack this to understand how it affects small business growth. Understanding CPI and Inflation The CPI is a…

Meta’s Threads App Sees Early Success, Drawing Advertiser Interest and Twitter’s Ire, Can Small Businesses Benefit?

Meta’s Threads App: A Beacon of Opportunity for Small Businesses? Introduction: Meta’s Threads App – The New Kid on the Block Meta’s Threads app, a recent entrant into the social media landscape, is experiencing rapid early success. This promising start has attracted considerable attention from advertisers and raised eyebrows at Twitter. Amidst all the buzz,…

Boost Your Small Business Income: Tap into a New Amazon Program for an Extra $27,000 Annually

Introduction: For small business owners, finding ways to increase income and sustain growth is a constant challenge. Thankfully, Amazon, the e-commerce giant, has introduced a new program specifically designed to support small businesses and provide them with an opportunity to earn additional revenue. In this article, we will explore this exciting Amazon program that has…

Understanding Short-Term Business Loans

Understanding Short-Term Business Loans Short-term business loans are a type of funding designed to meet immediate financial needs of businesses. As the name suggests, they come with shorter repayment periods than traditional business loans, often ranging from three months to a couple of years. Businesses typically utilize short-term loans to address cash flow shortages, fund…

How to Get a Small Business Loan

If you’re a small business owner, chances are you’ve considered taking out a loan to help finance your operations. But how do you know if you’re eligible for a small business loan? And what’s the process like? In this article, we’ll discuss everything you need to know about getting a small business loan. Let’s get…

Boosting Merchants Agility in Securing Short-Term Loans

The financial landscape is undergoing a seismic shift, powered by the advent of new technologies and analytical tools. These advancements are playing a vital role in shaping how merchants interact with and benefit from financial services, specifically in obtaining short-term loans. Technological Revolution in Financial Services In recent years, technology has broken down barriers in…

Banking Labyrinth Leaves Small Businesses Singed; Fintech Lending Emerges as Savior

Traditional banking systems have long been a cornerstone of American finance, yet recent events reveal a disconcerting trend. Small businesses, the heart of the nation’s economy, find themselves left in the cold by big banks, burdened by convoluted procedures, and often met with flat rejections. Amidst this grim scenario, Fintech lending is rising as a…

How to get an Unsecured Loan for a Small Business

Have you been receiving so many calls and do not know who to turn to in getting financing when your bank really is not the answer? We have the answers and can help you reduce those nagging calls, please read below and let us find you the solutions you need at Qualifier! Here are the…

How to Successfully Budget your Business

More profit, less loss Budgeting is important for a small business owner because it helps determine whether you are truly making a profit. It is wise to make smart estimates and match your expenses to your revenue, so you do not spend more than you bring in, or the contrary, not spend enough to grow your business. Although…

How Funding Can Improve Your Retail Store

t’s all about the customer experience By: Leah Virzi Working in retail. Some people love it, and some people hate it. It all depends on the type of store you are running and the experience you are willing to provide to your customers. Regardless of your situation, funding can always give your store an extra…